DeFi, in a clear and objective way

The main concepts, ideas and terms that make decentralized finance possible. 21 questions and answers about Decentralized Finance.

If you are a complete beginner in DeFi and cryptoactive, and want to better understand this subject, you are in the right place. This article is part of a series, created to clearly and objectively present various topics such as NFTs (previous post), DeFi, Stablecoins, Decentralization.

So let's look at the main terms and ideas that make decentralized finance (DeFi) possible. To make it easier for those who are not from the financial world, let's first understand the basic terms that will guide your journey. NFTs (post anterior), DeFi, Stablecoins, Descentralização.

1 - What is finance?

Finance is the management of money and includes activities such as saving, borrowing, lending, investing, budgeting, and forecasting. Finance can be seen as a social tool for managing resources, risks, and rewards across space and time. Today, financial services account for about 20 percent of global GDP.

2 - What is decentralized finance?

Decentralized finance is financial applications on an open, programmable blockchain for activities such as saving, lending, sending money, trading, investing, and more.

3 - What is DeFi?

Decentralized Finance or DeFi is the term used for applications that use blockchain technology to transfer value to broader financial activities.

Basically, DeFi or Decentralized Finance refers to financial services that are built upon distributed networks without centralized intermediaries.

4 - How big is the DeFi market today?

DeFi's market capitalization today is USD$110,868,160,678.56 with a total trading volume of USD$13,812,522,734.15 in the last 24 hours.

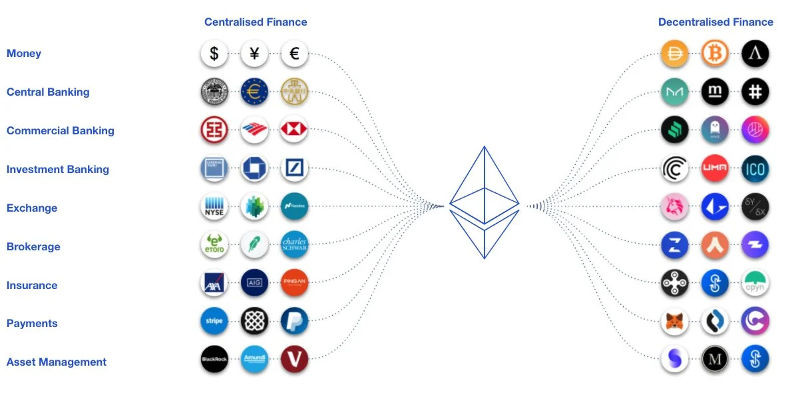

Most of DeFi's activity occurs on the Ethereum Blockchain.

5 - What solutions does DeFi offer?

DeFi provides solutions and new features for the same timeless economic needs: Pay, Save, Trade, Invest.

Ethereum can automate any financial activity, turning the activity into a "finance vending machine."

Think of the blockchain-based DeFi app as a vending machine that distributes financial transactions; when a coin (token) is inserted, a financial activity occurs.

6 - Why should I use or pay attention to DeFi?

Globally, 1.7 billion people cannot access simple banking services. Another billion have difficulty accessing sophisticated financial services, which impedes access to the formal economy and limits citizens' growth.

DeFi enhances current financial activities by extending their capabilities due to its programmable nature.

DeFi offers an alternative to your traditional financial system, enabling access anytime, anywhere with an Internet connection. Anyone can access DeFi products, as long as they have the necessary resources to send transactions over the network. Later on we will look at the advantages brought by DeFi.

7 - What made the existence of a system of decentralized finance possible?

Programmable blockchains are what made decentralized finance possible [DeFi].

8 - A quick reminder about blockchain and smart contracts ...

Blockchain technology relies on digital tokens and cryptocurrencies, species of the genus crypto-assets, which can transfer any kind of value, without intermediaries. The ownership of a digital asset is tracked using a special kind of distributed ledger that allows all participants to agree on who owns what (with varying degrees of privacy).

The most advanced blockchains support smart contracts that allow tokens and cryptocurrencies to be programmable, which means you don't need a big middle or back office to resolve, clear, and manage assets. Smart contracts make the most complex of financial products as easy as sending an email.

9 - What does DeFi have to do with Ethereum blockchain?

Blockchains give people the ability to model scarcity with computers and get everyone to agree on transactions of value, without the need to rely on intermediaries. Ethereum is the most widely used blockchain in the world and the basis of other applications, such as DeFi.

At the heart of DeFi is the ability to create open source, decentralized systems without the need for an intermediary.

10 - What are open source systems and why are they important for DeFi?

Being open source means that anyone anywhere can inspect the code to ensure its safety. It also means that people can share their knowledge and innovate new products and ideas quickly.

Just as it brings transparency and security, an open source blockchain helps the progress of science, and technical infrastructure, because it enables anyone, anywhere in the world, to improve or race software code.

11 - What makes Ethereum a programmable blockchain?

What makes Ethereum a programmable blockchain is the ability to store and execute computer programs within it.

These programs or computer codes are called smart contracts.

12 - Where does the business logic of DeFi applications lie?

Smart contracts are where the business logic of DeFi apps resides.

Since anyone can connect and interact with them, these financial apps don't need the permission of an intermediary to function.

In addition, all smart contracts reside on the same system, allowing data sharing to be seamless.

13 - What are Dapps? What do they do?

"Dapps, or distributed applications, are a new way of creating, managing, and running applications through blockchain."

A more technical definition is:

"Dapps are decentralized applications that use protocols (instructions for interactions between computers) to allow anyone to access them and create services on them without requiring permission from an intermediary third party or traditional trusted validator, such as banks, corporations, among others."

"The development of all the ramifications of Web 3.0 lead to very effective Dapps, capable of automating numerous business models."

14 - What improvements does DeFi bring?

DeFi Improves:

Funds transfer - instant settlement with transactions taking about 15 seconds.

Low transfer fees - The cost to send $1 or $1 billion is the same.

Lending - DeFi allows anyone to borrow capital, as long as they meet predefined parameters, regardless of their background

Lending - DeFi apps generally offer higher rates of return and streaming payments.

Decentralized exchanges - 24/7 access to trading markets with ample competition to keep rates low. These entities allow easy listing of any asset represented by cryptocurrency tokens since both reside on the same system.

Collateral with minimal risk - DeFi significantly reduces counterparty risk by using programmable, immutable, verifiable code to hold value and only disperse under agreed conditions. Peer-to-peer brokerage, with no intermediaries, efficiently and easily, without having to rely on a centralized entity or third party.

Fractional ownership of any asset - DeFi allows users to own a fractional share of any digital asset represented by a token.

Derivatives - DeFi platforms allow anyone to create synthetic exposure to any asset class. Because of their wide distribution, people outside of the U.S. markets can get exposure to U.S. equities at a lower cost in a simpler way.

Stablecoins - Digital currencies indexed to a currency such as the U.S. dollar allow users to hedge against local currency devaluation and retain their equity.

Governance - Transparent, decentralized organizations allow users to manage their money directly, eliminating the moral hazard of management charging excessive fees from an underperforming investment vehicle.

Markets - The creation of a 24/7 community owned and managed by the community.

Unlocking illiquid investments - DeFi introduces the ability for illiquid investments, such as real estate, to be tokenized and listed on the exchange markets.

15 - How is DeFi more advantageous than traditional financial applications?

DeFi offers several benefits compared to traditional financial applications:

Higher Returns: Although risky, accessing DeFi services can generate higher returns than traditional financial products

Unpermitted: There is no need to get approval from financial institutions to create or use services.

Broad access: anyone anywhere in the world with a computer can access or create innovative financial services

More Choice: Faster innovation in financial services.

Interoperability: the ability of services to interact easily.

Composability: the ability of financial services to mix, match, or extend themselves easily. They are modular like "money legos".

Decentralization: allows for a more robust system that is less prone to failure or systemic collapse.

Auditability: allows entities to easily verify transactions to make them more trustworthy.

Resistance to censorship: protects individual rights to participate in economic activity.

User Custody: Users retain complete ownership of their assets or data.

Point to Point: so users can engage directly and trade with few or no intermediaries.

Reduced risk: certain tools reduce counterparty risk.

Privacy: some projects are working to protect your privacy.

Cheaper: Lower fees, easier to move large amounts of money, and easier access to capital.

16 - What risks do DeFi applications pose, and what should users take into consideration?

While DeFi has enjoyed great success since its inception, the industry is facing some risks and challenges that may affect users and its adoption by mainstream organizations. For example, the data collection methods in DeFi are still being developed and there have been many instances of hacking. In addition, there is a shortage of regulatory compliance experts offering support to resolve regulatory scrutiny.

The main risks we can point to in DeFi are:

Greater user responsibility: since users can own assets without custodians.

New security habits: users need to learn new security habits with new technology.

Irreversible losses: created by user error.

High volatility: compared to traditional assets.

Technical risk: faulty code can lead to hacks and loss of funds.

Fraud: There are many fraudulent projects.

Phishing: hackers trick users into sharing confidential information.

Bad market fit: the product can fail, if the project design is not well structured by professionals such as blockchain strategists.

Illiquid investments: can lock up your funds and create opportunity costs.

Regulatory risk: DeFi has a wide range of use cases, outperforming, traditional financial services by having introduced the concept of staking (next question). However, regulatory scrutiny in this sector is crucial to extend trust and attract more organizations and investments from high net worth individuals. Regulatory oversight ensures that information linking users and transactions in these apps is available and can be retrieved when needed.

17 - What is Defi staking?

Staking is the process of maintaining funds in a cryptoactive portfolio to support the operations of the blockchain network. Essentially, it consists of holding cryptocurrencies for rewards.

Staking is the process of holding funds to receive rewards while contributing to the operations of a blockchain. As such, staking is widely used on networks that adopt the Proof of Stake (PoS) consensus mechanism or one of its variants.

18 - How can users earn interest through Defi staking?

Users can generate high interest rates annually just by holding their cryptoactive assets on DeFi platforms online. This is one of the simplest ways to generate interest with Staking.

19 - What factors govern DeFi staking rewards?

Staking duration

Assets staked per user / platform

Inflation rate

Net Issue Rate

20 - What is the concept of "Lock, Earn and Earn More" in DeFi?

Staking has become the most popular means of passive income for millions of users around the world. The extensive use of staking on the Ethereum blockchain is the main reason behind DeFi's popularity.

The concept of 'Lock, earn and earn more", which can be translated literally as 'Lock, earn and earn more' is also the goal of Ethereum 2.0, which will migrate to PoS (Proof of Stake) in an update known as Casper.

PoS (Proof of Stake) has a security mechanism called Proof of Stake that will exponentially increase transaction throughput on the Ethereum Blockchain.

21 - Could you give me an example of how the DeFi market works in practice?

Consider a money market that allows you to receive interest or borrow assets against collateral. In the traditional world, your collateral might be a house and a retirement loan might be the assets you borrow. For many people, obtaining such a loan would be a time-consuming process of filling out forms and providing legal documentation covering the property.

Not so in the DeFi world. Remember that everything is treated as a cryptoasset that already has value and ownership by definition. All that is required is to transfer some control of the cryptoasset to a smart contract to act as collateral for a loan. Based on the value of that deposit, new cryptoassets in the form of cryptocurrency can be minted (just as a bank creates new money when issuing a loan).

An example would be to put up ETH (Ethereum's primary cryptoasset) as collateral to obtain DAI - a stablecoin pegged to the value of the dollar (USD). This effectively removes the volatility of cryptocurrencies , which would experience large swings in value, making the price difficult for traders. Accepting DAI eliminates this problem while retaining all the benefits that cryptocurrencies offer (finality, reduced fees, reduced fraud, etc.).

Final considerations

Did you understand what DeFi is? Did you understand why DeFi is useful? We will get back to this subject here at BChain Connection soon.

If you enjoyed the content, don't forget to give us your Like so that we can continue to produce quality content that is accessible to everyone.

See you soon

Copyright @ Tatiana Revoredo, 2021. All rights reserved. No part of this article may be reproduced in any form or by any means without written permission of the author, except for brief quotations mentioning the author in teaching materials and for other non-commercial uses.